Qualified Invoice System for Freelancers in Japan: Pros and Cons of Registration

The Qualified Invoice System (QIS), introduced in October of 2023, marked a significant change for freelancers in Japan. In this article we evaluate the potential pros and cons for registering and against registering for the QIS. The key is to understand your main clients’ preferences and to align with your long-term business strategies.

Drawbacks of Qualified Invoice System (QIS) Registration and Non-registration for Freelancers in Japan

There are potential drawbacks for freelancers whether you choose to register for the QIS or not. Let’s take a look from both sides:

Drawbacks of QIS Registration

1. Increase in tax payment Freelancers with annual sales of ¥10,000,000 or less, or those who have been in business for less than 2 years are currently exempt from paying Japan’s Consumption Tax (JCT). However, registering for the QIS will effectively increase the tax burden on the freelancer, as this exemption no longer applies for QIS-registered freelancers.

2. Increase in tax administration burden Freelancers registered with QIS are required to file both JCT and income tax declarations in their yearly Final Tax Returns. In principle, the amount of JCT is calculated by subtracting “the JCT paid with expenses” from “the JCT received with sales.” This means it requires time and effort to correctly record JCT on a regular basis.

A particularly tricky aspect of this calculation is the need to separate items subject to different tax rates. For instance, when buying a newspaper and a pen at a convenience store, it's necessary to record the JCT for the newspaper as 8% and for the pen as 10%.

However, the “20% Special Treatment” system was introduced to ease this aspect of adopting the new system.

The 20% Special Treatment system is a simplified calculation which allows you to simply pay 20% of JCT received from revenue. If revenue is ¥5,000,000, the JCT received would amount to ¥500,000. Therefore, 20% of this (¥100,000) is required to be paid as JCT. The amount of JCT will be automatically determined according to revenue, so recording and calculation will not be necessary.

.jpg?updatedAt=1715143603927)

However the 20% Special Treatment system for freelancers operating without an incorporated company is only available until December 31, 2026. Additionally, since JCT refunds are available in case of an incurred loss for a given fiscal year, it is generally advised to document JCT normally.

Drawbacks of QIS Non-registration

1. Contract Renewal Risk If you choose not to register for QIS, you will still be able to invoice JCT to your clients. It is generally not acceptable for clients to demand price reductions or enforce registration for QIS.

However, in this scenario, clients won't be able to deduct the JCT they've paid to you from the JCT they've received with their own revenue. In other words, their tax burden will increase when working with freelancers who don’t register for QIS. Some clients may consider switching to contracting with a QIS registered business instead.

2. Competitive disadvantages Non-registration may be challenging for landing new clients too. If a potential client is comparing multiple similar freelancers, there is a possibility that a QIS registered freelancer may have an advantage.

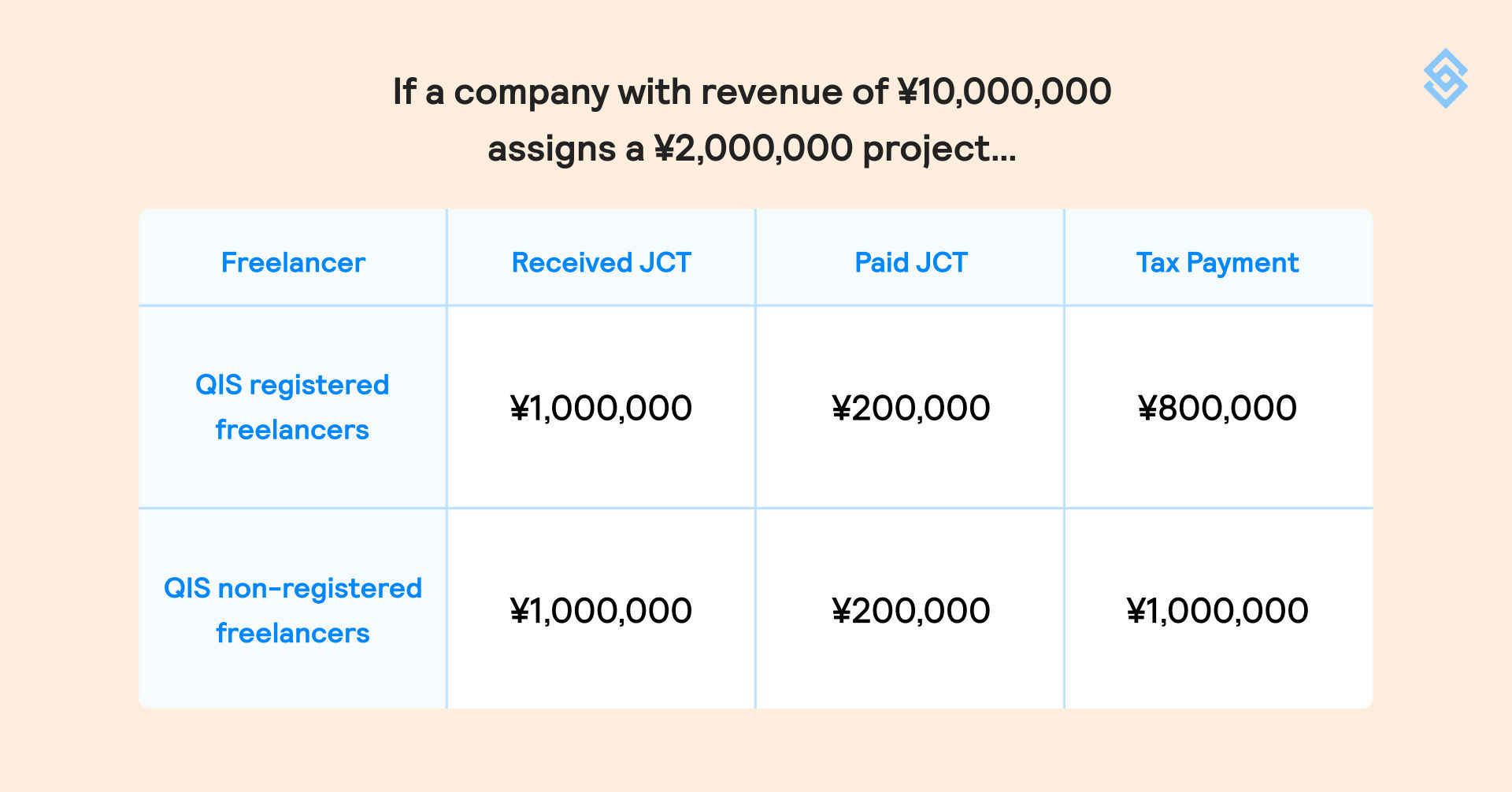

For example, if a company with revenue of ¥10,000,000 assigns a project worth ¥2,000,000 to a freelancer: Working with a QIS registered business, the JCT the company will pay would be ¥1,000,000 - ¥200,000 = ¥800,000 whereas working with a QIS non-registered freelancer, they would pay the full ¥1,000,000. Given the discount on JCT, it would not be surprising for some companies to prioritize QIS registered freelancers moving forward.

Let's look at two key points to consider for QIS registration:

1. Client-Centric Approach: Prioritizing Main Clients’ Preference for Qualified Invoice System Registration

Confirming the preferences of your main clients is essential. In fact, some clients may not require QIS registration if they fall under certain categories:

- Clients with tax-exempt status - Clients with 20% special treatment application or part of the simplified taxation system - Clients with overseas companies exclusively, with services falling under export - Clients with general consumers exclusively (e.g., retail stores or restaurants)

Depending on your clientbase and relationships, it’s certainly possible for QIS non-registered freelancers to continue under the same terms as before.

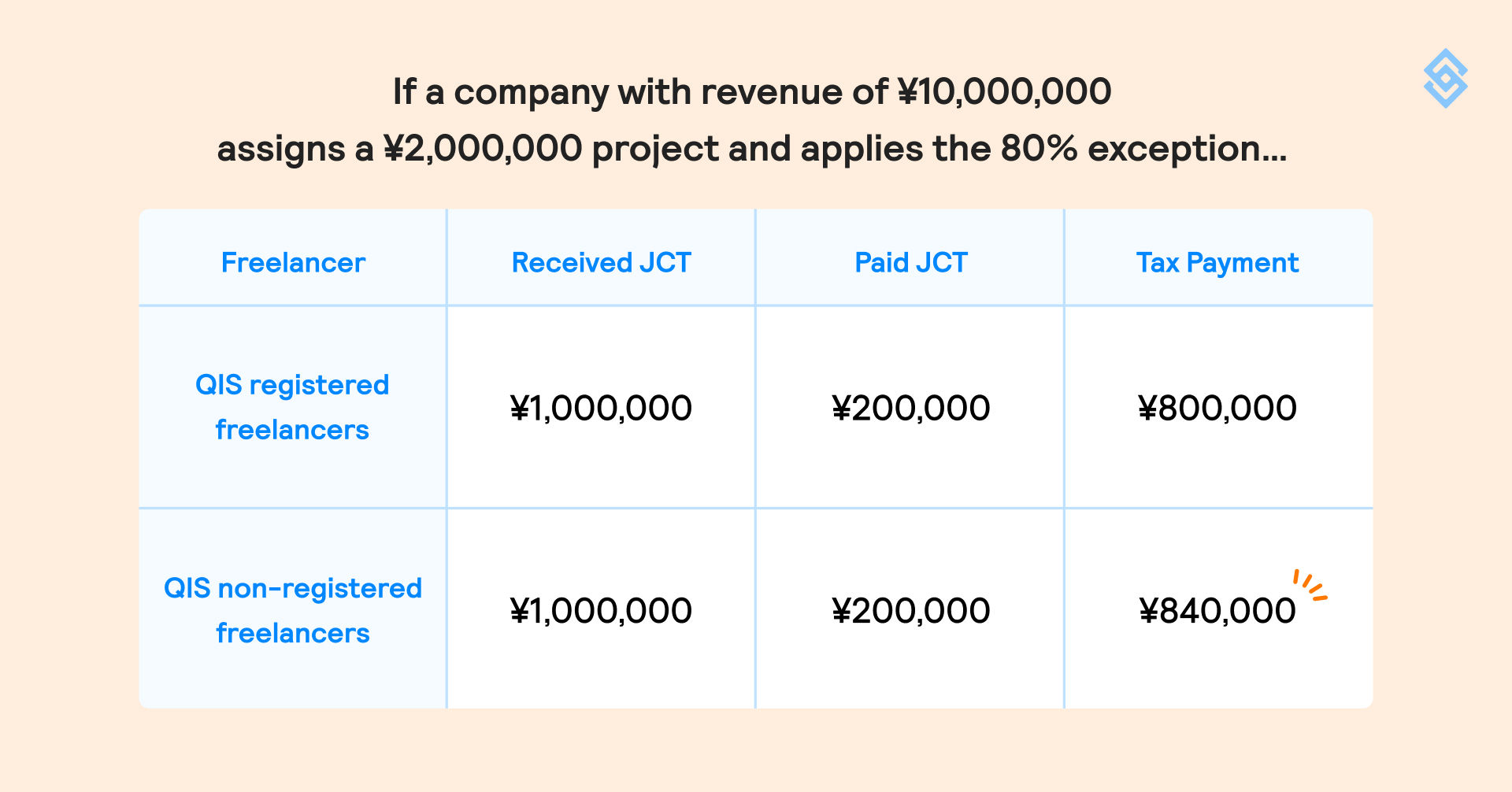

This can also be due to tax exemptions for the client. With the exemptions applied, they will be able to deduct a certain percentage from purchases from QIS non-registered businesses. The deduction rate is 80% until September 2026 and 50% until September 2029.

Let’s see how these exceptions will affect the previous examples. If the company with sales of ¥10,000,000 assigns a ¥2,000,000 project mentioned earlier, the ordering party can deduct 80% of the ¥200,000 of paid JCT by the QIS non-registered business, which amounts to ¥160,000. Resulting the tax payment for the companies to be ¥1,000,000 - ¥160,000 = ¥840,000.

Another option is to take this opportunity to renegotiate terms. Considering the current trend of companies implementing wage increases due to inflation, it's an opportunity for freelancers to improve their rates. This may be a good opportunity to proceed with QIS registration at the same time.

2. Long-term Strategic Approach: Crafting Business Strategies for Qualified Invoice System Registration

Do you plan to continue keeping your annual revenue below ¥10,000,000? Or do you have intentions to grow your business beyond this point?

If you intend to grow your business beyond ¥10,000,000 annual revenue, this may be an opportunity to formulate a growth strategy with QIS in mind. Not only will the QIS registration be a favorable quality when finding new clients but also as your obligation to pay JCT starts two years after sales exceed ¥10,000,000, QIS registration could be a strategic move for you to take.

If you are uncertain about how to proceed with business growth, consider joining a community where you can connect with other freelancers. Additionally, if you’re not a full-time freelancer, securing a steady stream of projects can help ensure a steady income. Don't be afraid to shake things up by trying out Sollective or tweaking your job search approach!

Consider learning more about the “Small Business Sustainability Subsidy” grant to expand your business: Newly registered QIS freelancers can apply for this grant to expand their business. We recommend consulting subsidy specialists such as tax accountants for more details, as there is no information available in English at this time.

I hope this article has provided you with a clearer understanding of QIS. We acknowledge that everyone's circumstances vary, and decisions may differ accordingly. That's why our community exists — to support one another in making the best decisions for our collective growth and learning.